Over Twenty thousand unpaid customers of Gold Coast Fund Management under the umbrella name ‘Convenor for Coalition of Aggrieved Customers of Gold Coast Fund Management,’ convinced that they may not get their monies anytime soon, have petitioned International Monetary Fund (IMF), to direct Government of Ghana to fully restore the economic rights of victims of the financial sector reforms under President Akuffo Addo.

The convener of the group, Charles Nyame, said at a press conference at the Osu Presbyterian church in Accra, yesterday, that, “We humbly request for your prompt intervention, even in this occasion as the Government of Ghana has opted for the IMF bailout, kindly bailout the Aggrieved Customers of Gold Coast Fund too.”

“It is worthy to appreciate that issues of economic rights are issues of fundamental human rights-the rights to acquire and possess wealth through legal means. Ninety percent of our members are retirees who invested their pension in a Fund Management Company regulated by Securities and Exchange Commission of Ghana. For twenty – five years in its operations, Gold Coast Fund Management never defaulted in payment of customers investment, either on maturity or abrupt request by investors, until the introduction of the financial sector clean up exercise policy by President Akufo Addo led government,” Charles Nyame intoned.

In November 8th, 2019, the Securities and Exchange Commission revoked the operational licence of Gold Coast Fund Management with the Government assurance to pay the over hundred and twenty thousand (120,000) investors of the company with investment portfolio of over five billion Ghana cedis (GHS 5,000 000 000.00).

According to him, a budgetary allocation of five point five billion Ghana cedis (GHS5,500 000 000.00) was earmarked and approved by Parliament in the year 2021 budget, although payment had not been affected from the allocation yet had been captured at the expenditure of 2022 budget.

It is worthy to bring to your attention that, as a result of delayed payment of investors locked up funds, over five hundred (500) of our members, mostly pensioners, have died as a result of not been able to access their investment for medical treatment, Charles Nyame intimated.

About five thousand and seventy- six (5076) businesses of some of our members, the petitioners disclosed, have totally collapsed, rendering over sixteen thousand (16000) workers jobless because business owners cannot access their investment to run their businesses, adding that “one thousand three hundred and twenty – five (1325) students have either deferred their University courses or delayed their entry into universities, all because investment made towards their education is locked up for over three years.”

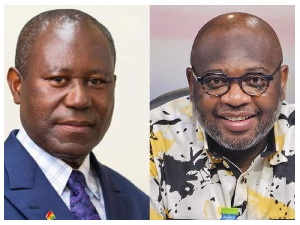

He called on the President to redirect Mr. Ken Ofori Atta, the Minister for Finance to resource the AM- FUND of GCB CAPITAL with the already approved 5.5 billion allocations in the year 2021 budget for immediate payment to the customers of defunct fund management companies without a condition of any liquidation order.

Considering the economic crisis of the day, the group suggested government paid 50 percent cash value and 50 percent short term bond coupon to investors whose investment portfolio spans beyond a million Ghana cedis (GHc 1,000 000). In the same vein, “we expect the government to make affront payment of100 percent cash value of all investment portfolio below a million cedis.”

“Our second appeal goes to His Excellency the Vice President Dr. Bawumia, we humbly request him as an astute economist to rise to the occasion with immediate intervention to curtail the needless death of the vulnerable among the customers, especially the pensioners and the physically challenged,” he added.

Government, Mr. Nyame said should pay the dying customers whilst it continues to battle with Dr. Papa Kwasi Nduom in the law court.

Discussion about this post