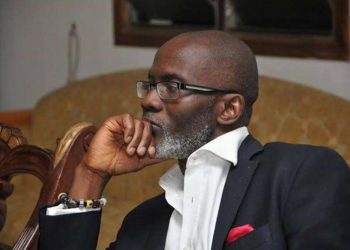

An Economist and Political analyst Mr Alex Emmanuel Nti has hit hard on the government’s continuous borrowing leading to the IMF for a bailout.

Speaking on Plan B FM’s late afternoon show EBAANOSEN with Ohene Kinnah, Mr. Nti stated that President Akufo Addo before assuming office promised Ghana beyond aid but what is happening now is that the country is on a borrowing spree.

“We can do this because we are a nation of smart, dedicated, and hard-working people; a nation blessed with abundant natural resources and a nation that has maintained peace and political stability and has earned international respect and goodwill.”

“If the president has said all this and still borrowing, i won’t blame him (President) because he is not an economist but rather i will blame the economic management team especially the chairman of the team, Vice President Dr. Bawumia, and The Finance Minister Ken Ofori Atta are they not aware of the implications on too much borrowing, they should be blamed for all these atrocities” he added.

This was in reaction after the International Monetary Fund (IMF) revealed details about how Ghana’s four collateralized loans from China have exposed the country to losing parts of its mineral resource revenue in addition to electricity sales.

This loan agreement means in the event Ghana defaults on honoring its debt obligation, China has the right to use proceeds from Ghana’s oil, cocoa, bauxite, or even the sales from electricity to settle the debt.

In a lot of debt negotiations taking place within the developing world, China appears to be the most important party at the negotiation table

Checks show the WesAfricanca nation has contracted at least 8 collateralized loans from China with different mineral resources as security against default

As of the end of 2022, Ghana owed China $1.9 billion out of which $619 million were collateralized loans.

According to the Fund, Ghana’s collateralized debt as of the end of 2022, was entirely held by China, this corresponds to four loan agreements signed in 2007-18 that amount to US$619 million to finance infrastructure projects

These loans are collateralized against commodity production (cocoa, bauxite, and oil) and electricity sales.

Discussion about this post