The Ghana Union of Traders Association (GUTA) has hinted it will pursue the government to review three tax revenue measures and the Covid-19 Levy in the mid-year budget.

According to the union, businesses are struggling to survive due to the high taxes and utilities they are paying.

It contends that the IMF is against suppressing the growth of the private sector, hence it will intensify engagements to have the taxes reviewed in the mid-year budget.

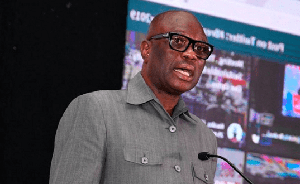

Speaking to Joy Business, GUTA President, Dr. Joseph Obeng, said the union will dialogue with government to consider reviewing some of the taxes in the mid-year budget to cushion businesses in these austere times.

“Now that the IMF deal has gone through, we will still pursue government and dialog so that at least in the mid-year budget, we can make some revision so that businesses can have some respite”.

He added that the current IMF deal creates the environment for engagements therefore GUTA will take advantage of this opportunity and lobby for some reviews to be done before the mid-year budget is read.

“We believe that any proposal that we give to the IMF, because they do not seek the destruction of businesses, we can still go to the table and discuss things. We will look at how some of these taxes can be lowered to cushion businesses in the country”.

On June 1, 2023, water and electricity tariffs went up by 18% per unit.

The Public Utilities Regulatory Commission (PURC) justified its decision to adjust tariffs, saying, the move was needed to sustain the operations of the various companies in the production and distribution chain of electricity.

But some businesses complained that this could worsen their plight as they are already struggling with high taxes and inflation.

For instance, the Ghana Hotels Association warned of a potential collapse of businesses if the taxes are not reviewed.

Discussion about this post