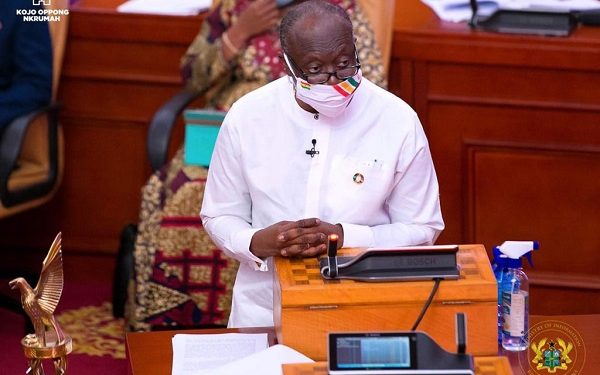

As scheduled, the government has held the town hall meeting to interact with the ordinary Ghanaians and give further education on the importance of the e-levy. The Finance Minister, Communication Minister, and Deputy Majority Leader successfully convinced the majority of the people present into realizing the relevance of the e-levy.

After the presentations by the guest, the information minister allowed the Ghanaians present to ask questions and if possible give their suggestions. The first nine people who were given the opportunity to speak explained that the town hall meeting had broadened their horizon on the concept of the e-levy and as such, they gave their full support to the government.

However, one student in the crowd stood and boldly stated that he was fully against the e-levy. When asked to explain what he disliked about the e-levy and why he disapproved it, he threw these bold questions to the Finance Minister.

1. How do we categorize the e-levy? Is it another income tax, capital tax, sales tax, payment tax, or all of the above?

2. Corruption is one of the problems that receive lips service in Ghana. The Auditor-General indicates that about 12 billion Ghana cedis remain unaccounted for over the last few years. Why does the e-levy rake in only 6.9 billion rather than recovering the 12 billion?

3. Proceeds from e-levy are pegged towards road construction and transportation development and youth unemployment. What happens to the previously earned levies?

Discussion about this post