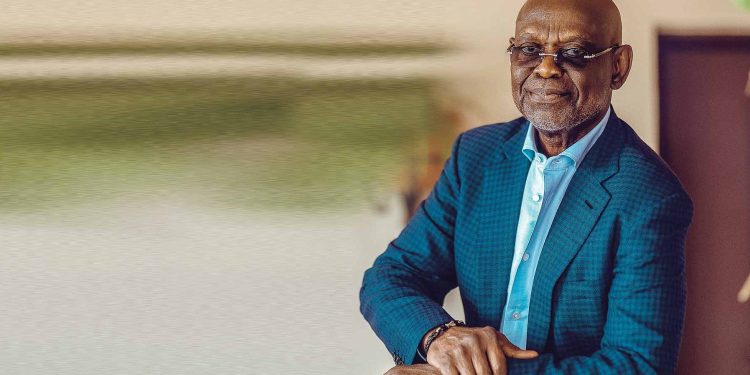

A former Finance Minister, Prof. Kwesi Botchwey, does not subscribe to the idea of borrowing money from international financial agencies such as the International Monetary Fund (IMF) to revive Ghana’s economy.

He posits that borrowed money always comes with strings attached.

“When money is borrowed, it is required that we put our public finances in a position to settle our debts. When servicing our debts can only be done at the expense of delivering public services, especially to the poor and vulnerable, then we are in trouble.”

“This is the predicament that we find ourselves in today. The issue really is not whether we go to the IMF or not. That is a red herring. Indeed, we are a sovereign nation, and a proud one at that and can decide as to whether or not to seek after the IMF. The IMF with all its power and leverage can simply not force a programme on us or any country.”

“An important lesson however as we all know is that borrowed money comes always with strings attached. There is no such thing as free money with absolute no conditionalities. Our sovereignty comes with the right to manage or mismanage our economy the way we please.”

He rather agrees with the “principle of national ownership of development policy.”

“But we must know that we will reap the whirlwind if we should fault on account of our own policy choices,” he added.

Prof. Botchwey further proposed some four solutions to the current economic quagmire of the country as elaborated below;

1. It is idle to pretend that we can address our economic issues without some hardship, at least in the short-term. There is simply no silver bullets or magical solution somewhere that can bring lasting relief without some level of pain and sacrifice. The real question is how we distribute this hardship in an equitable or transparent manner.

Throwing more light on this, he said “it is inequitable to have grants of about 1.5 million beneficiaries of LEAP programme unpaid for months, because you are in a crisis. That is not where the hardship to hit.”

2. The real problem with our public finances is structural and will require a thorough review of all sources of pressure in the budget including every flagship programme and it’s sustainability and impact, all the options must be on the table. We must not for instance transition temporary spending incurred during the pandemic into permanent public spending, when we are already struggling to collect revenues.

3. We must resist the lure of solutions that will further mortgage the future of young generations to come, such as collatoralising public revenue steams. Above all, we must resist solutions that we delay hard decisions.

4. The country needs to build consensus around the reforms that are necessary to resolve the nation’s creditworthiness.

The lecture was designed to provide a constructive platform for engaging and shaping solutions for the socio-economic challenges and prospects of Ghana.

Organized by the OneGhana Movement in partnership with the University of Ghana Department of Economics and School of Social Sciences, the event was held at the Cedi Conference Centre at the university’s Department of Economics.

Discussion about this post