Sacked MIIF CEO, BOST, BoG face scrutiny; Mahama & others in Dubai to address crisis

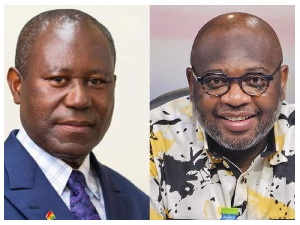

Reports, have emerged about the dismissal of Edward Nana Yaw Koranteng, Chief Executive Officer (CEO) of the Minerals Income and Investment Fund (MIIF), with sources linking his removal to millions of dollars in losses incurred under the Gold-for-Oil (G4O) programme, which has faced substantial financial setbacks and operational challenges.

Initially lauded for its potential to stabilize fuel prices and leverage Ghana’s gold resources, the G4O programme, has reportedly suffered a staggering $90 million loss, despite recording strong profits in its early stages.

The situation worsened, when a licensed company responsible for purchasing gold for the initiative, allegedly absconded with funds. These revelations are said to have surfaced during transition meetings as the Mahama administration took office.

Further investigations, indicate a possible connection to LITASCO SA, a Swiss-based international marketing and trading company with operations in refinery and retail networks across Europe.

It is reported that a meeting involving President John Dramani Mahama and some of his new appointees was held in Dubai to address the fallout from the programme and explore potential solutions.

The Bulk Oil Storage and Transportation Company Limited (BOST) and its management led by its Managing Director, Dr Edwin Alfred Nii Obodai Provencal, are also reportedly implicated in the G4O programme’s mismanagement and financial losses.

Meanwhile, the Bank of Ghana (BoG), has come under scrutiny for its secretive role in the programme. Unconfirmed reports suggest that a Zenith Bank account was established to facilitate trading activities under the initiative.

The abrupt departure of the MIIF CEO, has raised questions about accountability and transparency in managing Ghana’s natural resources.

Critics have called for a thorough investigation into the losses incurred under the G4O programme and the roles of key stakeholders, including BoG, BOST, and the now-dismissed MIIF leadership.

The Mahama administration, is expected to take steps to restructure key agencies and rebuild public trust, the controversy surrounding the Gold-for-Oil programme underscores the need for greater oversight and transparency in managing national resources.

The appointment of Justina Nelson as Acting CEO of MIIF, is seen as Mahama’s move to stabilize the agency and restore confidence in its operations.

The public eagerly awaits further clarity on the matter, as calls grow for an independent inquiry into the programme’s mismanagement and financial irregularities.

The Gold-for-Oil (G4O) programme was an initiative of the Akufo-Addo government to use the existing BOG Domestic Gold Purchase (DGP) programme to provide import finance facilities to support the importation of petroleum products into Ghana.

The Bank of Ghana (BoG) in August had asserted that the government’s Gold for Oil policy is progressing as planned.

The initiative was launched by the Akufo-Addo government to address Ghana’s depleting foreign currency reserves and the high demand for dollars by oil importers, which was exerting downward pressure on the Cedi and driving up living costs.

During an appearance before the Public Accounts Committee of Parliament on Monday, August 12, 2024, the First Deputy Governor of the Bank of Ghana, Dr Maxwell Opoku-Afari, provided an update on the policy.

“The gold for oil programme is on track and the reason why the risk for the separate account is mitigated somehow is that the Central Bank’s participation in terms of financial contribution to the gold for oil is capped and nothing more is being added to that.

“So it is the receivables that are coming from within that cap amount that has been used to continue to finance the gold for oil programme.”

The Gold for Oil policy, as explained by the government, is to allow the government to pay for imported oil products with gold, in a direct barter with gold purchased by the Central Bank.

According to the previous government’s G40 Programme Framework dated February 3, 2023, which explains the policy, payment for the oil supply is done in two channels; barter trade or via forex obtained from selling gold to a broker.

Under the barter channel, suppliers willing to take gold in direct exchange for petroleum products will be provided with the equivalent volume of gold by the Bank of Ghana (BoG).

Under the Broker Channel, the BoG executes a gold supply agreement under which it sells gold to a gold broker, which provides forex cover to pay for petroleum products.

Discussion about this post