Kwahumanhene Daasebre Akuamoah Agyapong IIhas stepped down from his position as Board Chairman of the Agricultural Development Bank (ADB) following allegations of extortion involving over GHC2 million.

His resignation, which takes immediate effect, comes after a customer of the bank, Collins Darkwa, accused him of demanding money in exchange for the approval of a loan.

According to a statement from ADB, the decision to step down was made during an emergency board meeting held on Thursday, during which Daasebre Akuamoah Agyapong II, who also serves as the Kwahumanhene, chose to resign in the best interest of the bank.

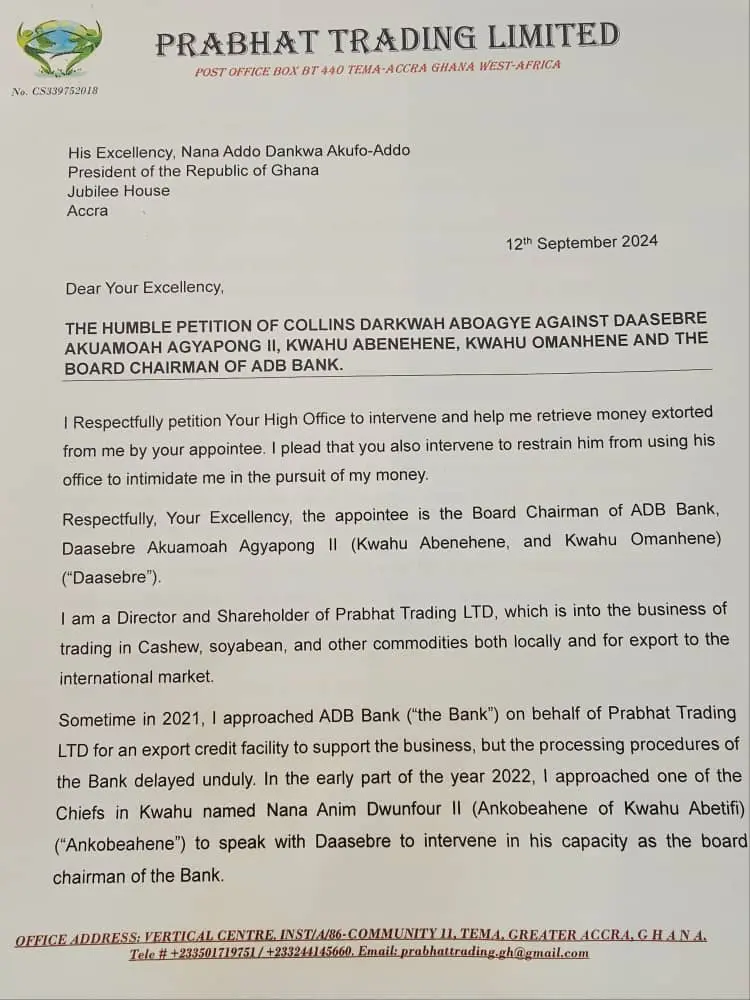

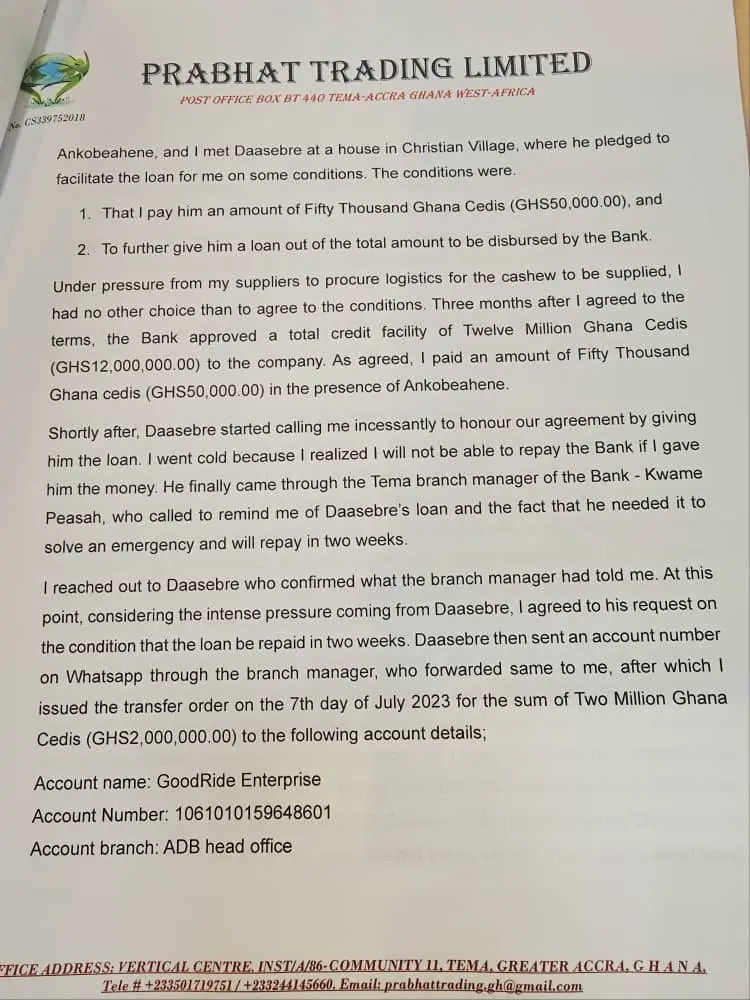

The allegations stem from a petition filed by Collins Darkwa to the Office of the President. In the petition, Darkwa claims that the Board Chairman demanded GHC50,000 upfront and additional funds in return for facilitating a GHC12 million loan. Darkwa described how, under financial pressure from his suppliers, he had no choice but to comply with the demands.

“Under pressure from my suppliers to procure logistics for the cashew to be supplied, I had no other choice than to agree to the conditions,” Darkwa said in his petition.

Despite complying, Darkwa alleges that the Kwahumanhene continued to press him for more money, even threatening to use his influence as Board Chairman to frustrate Darkwa’s business operations if he failed to make further payments. The businessman has appealed to the Presidency to help him recover a total of GHC2,408,000 from the former Board Chairman.

The swift resignation of Daasebre Akuamoah Agyapong II has brought relief to many within the bank, with observers noting that this action demonstrates the bank’s commitment to good corporate governance. ADB is considered one of the best-performing local banks, and the decision is seen as reassuring to its customers and the general public.

ADB, which won the Ghana Banking Award’s Most Socially Responsible Bank twice and the Best Corporate Social Responsibility Bank at the Ghana Business Awards, continues to distinguish itself among its competitors. The bank, listed on the Ghana Stock Exchange in 2016, offers a range of banking services, including consumer, corporate, SME, agribusiness, and trade services, with a strong focus on agriculture.

The current ownership structure of ADB includes:

- Financial Investment Trust – 64.05%

- Government of Ghana – 21.50%

- Ghana Amalgamated Trust PLC – 11.26%

- Retail investors and ADB staff – 3.2%.

A petition filed by Collins Darkwa to the Office of the President

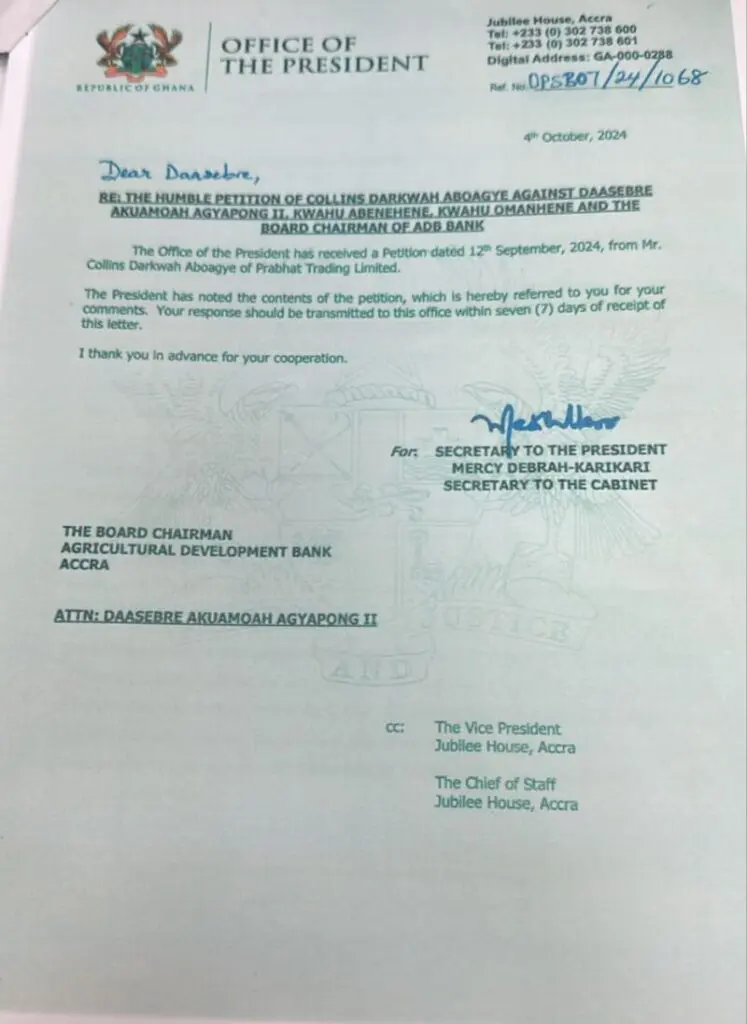

The Office of the President’s letter

Discussion about this post