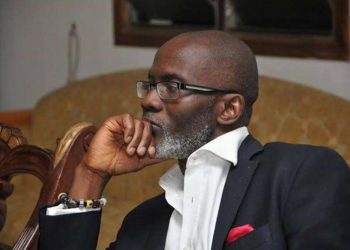

The founder and Chief Executive Officer of Springfield Energy, Kevin Okyere, has emerged as the trusted front man of the Energy Minister, Dr. Matthew Opoku-Prempeh alias “NAPO” who came close to being fired by President Akufo-Addo, for showing him utmost disrespect by refusing to carry out a stern instruction over an important transaction priced at US$550 million.

In a recently concluded transaction between Occidental (Oxy) and Kosmos Energy for the takeover of the former’s stake in the Jubilee and TEN fields, “NAPO” sought to rely on Kevin to throw a wrench into the transaction that has taken months to negotiate.

NAPO, Kelvin, Gabby and KK Sarpong, had wanted to scuttle the Occidental (Oxy) and Kosmos Energy US$550 million deal by forcing in Kevin’s Springfield and International Petroleum Corporation (IPC) quoting US$750 million as their bid price.

According to our trusted sources, International Petroleum Corporation (IPC) approached the Energy Minister with a proposal to buy the stake of Oxy in Ghana.

Dr. Opoku-Prempeh, rather referred the proposal to his front man to partner IPC with his company (Springfield) to put up a counter bid.

In the haste to make a deal out of the situation, IPC, Dr. Opoku-Prempeh and Kevin, assumed some authority they do not have; they made an offer to Ghana National Petroleum Corporation (GNPC) rather than the company (Oxy) that was selling the assets.

With full knowledge of what he was scheming, Dr. Opoku-Prempeh, began to frustrate the transaction between Oxy and Kosmos by delaying his approval.

This had to take the intervention of the President after he went to Texas to meet Kosmos and Occidental in September.

After meeting the companies, the president gave specific instructions for the deal to be approved by the Energy Minister.

However, at his usual best, Dr. Opoku-Prempeh, ignored the President and kept it at the ministry of energy to frustrate the transaction.

This Compelled Oxy to write a letter to Dr. Opoku-Prempeh to strongly indicate that if he (Energy Minister) failed to approve the transaction by October 13, 2021, they would not proceed with the sale of the asset to anybody else. That could only incite the flamboyant anger of the “prince” of Ghana’s Energy sector to entrench his position to frustrate the transaction.

It appears Dr. Opoku-Prempeh, was not alone, but had the support of the GNPC boss KK Sarpong and Gabby AsareOtchere-Darko, the President’s trusted cousin with Nana Bediatuo Asante, also in another corner pursuing his own agenda and financial interest.

Two clear weeks after President Akufo-Addo had instructed the approval of the Oxy-Kosmos transaction, his cousin; Gabby was using his media house Asaase Radio to tout the benefits of GNPC opting for the Springfield-IPC proposal.

KK Sarpong, the expert “Over-valuer”, had also begun engaging Kevin’s Springfield and IPC to put US$750 million bid, as though they were the owners of the asset, having been consumed by the mistaken belief that they could front for Springfield and IPC.

While, Dr. Opoku-Prempeh, Kevin and KK Sarpong kept to their corner, another member of the Akufo-Addo family, the Executive Secretary to the President, Nana Asante Bediatuo, emerged to do more damage to Oxy and Kosmos.

He is also believed to have come up with another company, Protronor, at the last hour, despite being privy to the directive of the President for the Minister of Energy to approve the transaction between Oxy and Kosmos.

It came to the attention of the President that NAPO and his cousins, have disrespected his orders and kept at a tussle for the assets.

On Tuesday October 12, 2021, it came to the attention of President Akufo-Addo that Oxy, had written to Dr. Opoku-Prempeh with Wednesday October13, 2021 deadline.

President Akufo-Addo, called for an emergency meeting at the seat of government; Jubilee House to find a solution to the problem.

The Herald’s sources indicate that Dr. Opoku-Prempeh, refused to pick the call of the president and hence did not participate in the meeting.

However, the presence of Gabby, Egbert Faibille, the CEO of the Petroleum Commission and KK Sarpong was enough for the crunch meeting to agree that Dr. Opoku-Prempeh approves the transaction before the close of day October 13.

This left the Energy Minister with no option than to approve the transaction to save his job, after causing the old man to stay up to 12 midnight to find a solution to his mess driven by greed and selfishness.

Interestingly yesterday, the Energy Minister, pretended everything was fine betweenhim and the outgoing company he had tried to outsmart when news from his ministry said “Hon. Dr. Matthew OpokuPrempeh, has applauded the move by Anadarko Petroleum Ghana to transfer new shares to Kosmos Energy Ghana”.

“At a meeting at the Ministry of Energy in the presence of officials of the National Oil Company, Ghana National Petroleum Corporation (GNPC), the Energy Minister described Anadarko’s decision to transfer their existing shares in the West Cape Three Points (WCTP) to Kosmos Energy as a step in the direction. He said selecting Kosmos as their preferred buyer is also very much in order as they exit the petroleum agreement between the company and Ghana”.

It went on to say that “Dr. Prempeh underscored the essence of due diligence in the transfer process , as he on the back of the available information and briefing expressed consent to the sale and transfer of shares”.

“The Minister indicated Ghana’s commitment to sound Investor Relations. This cordiality in his view would ensure that Ghana judiciously exploits its petroleum resources for the benefit of its people”.

But interestingly, the sale of Oxy assets of two producing fields (24% on Jubilee and 17% on TEN) at US$550 million raises fundamental questions about the recent Aker Energy’s asking price for its Pecan and AGM fields. Jubilee and TEN are producing fields that generate revenue from day one of purchase. Yet GNPC did not pay attention from the beginning when Oxy wanted to sell, only to appear last hour as a front for other companies. But rather focused on the asset that Aker has been struggling to sell at $300 million. The worst part, GNPC was willing to pay $1.3billion for the undeveloped assets. The whole nation is waiting to hear the outcome of the recent negotiations with Aker which saw a battalion of GNPC officials relocating to Dubai to engage Aker.

According to some insiders, the demand of Civil Society Organization (CSOs) for the two fields (Pecan and AGM) to be treated separately is being heeded. This has recently been confirmed by Gabby on his Asaase radio website. But the value of the asset is not receiving much attention because that will affect what the politicians will get from it.

Recently, the African Intelligence, a leading professional news portal specializing in political and economic developments on the continent reported on this matter under the headings “Springfield tries to outbid Kosmos for Occidental’s former Anadarko fields” and “Oxy pushes energy ministry to approve Kosmos Energy deal”.

It said “Ghanaian oil junior Springfield Energy has formed a partnership with Sweden’s Lundin family to bid against US group Kosmos for the stakes in the Jubilee and TEN fields held by the Anadarko group prior to its takeover by Occidental Petroleum.

The trench warfare is continuing between the companies engaged in the battle for the stakes formerly owned by Anadarko in Ghana’s Jubilee and TEN (Tweneboa, Enyanra and Ntomme) oil fields. As we revealed, Kosmos Energy has been leading the pack for several months. In mid-September, in an attempt to get final approval from the Ghanaian energy ministry, it offered Ghana National Petroleum Corp (GNPC – AI, 24/09/21) a 7% stake in the fields, to be paid for by GNPC at a prorata price based on the valuation given them under the terms of the deal.

A new arrival has joined the battle, however, with an offer which appears to be even more attractive for state-owned GNPC. In September, executives from Ghanaian oil junior Springfield Energy, a company headed by Kevin Okyere, met GNPC boss Kofi KoduahSarpong to present an offer which would give GNPC a 7% stake in the fields at no direct cost to itself.

In a confidential letter to Sarpong dated 20 September, Okyere went further, offering GNPC a 10% stake in the fields at no charge to itself and agreeing to drop its claim to $37m still owed Anadarko by the Ghanaian state. The state-owned company needed only to convince the finance and energy ministries to accept the deal. Okyere estimated in his letter that Anadarko’s former 24% stake in Jubilee and its 17% interest in the TEN fields was worth a total $750m.

Swedish Partner

The letter was signed by Okyere but also by International Petroleum Corporation (IPC) chief executive Mike Nicholson. IPC is linked to Swedish conglomerate Lundin Group, which has a 30% shareholding in it. IPC does not yet have any assets in Africa but produces 44,000 barrels of oil equivalent daily on its permits in Malaysia and Canada. Springfield indicates in its letter that IPC will be in charge of finding the necessary cash for both companies, which may be an easy task given Lundin Group’s very deep pockets.

Springfield is not unknown in Ghana. It is already active on the block adjacent to ENI’s Offshore Cape Three Points oil and gas block. Springfield claims that the only well drilled on its block has found a field known as Afina which extends into ENI’s block. This is vehemently denied by ENI (AI, 05/07/21), which considers that other wells need to be drilled to find out whether or not Afina is indeed an extension of its own Sankofa field, which is already in production. If it were the case, joint development of the field would need be envisaged. Okyere has the backing of the energy ministry in the dispute. The ministry has already asked ENI to unitize Sankofa and Afina, which the Italian group has so far refused to do.

On 13the October 2021, the portal did the second write up with the headline “Oxy pushes energy ministry to approve Kosmos Energy deal”.

It said that “as the sale of its Ghanaian assets drags on, Oxy has decided to give Accra an ultimatum.

Keen to sell its 24% stake in the Jubilee oil field and its 17% stake in the TEN (Tweneboa, Enyenra and Ntomme) fields to Kosmos Energy and Ghana National Petroleum Corp (GNPC), Anadarko WCTP is doing everything it can to get energy minister Matthew OpokuPrempeh to quickly validate the deal. Registered in the Cayman Islands, Anadarko WCTP has been owned since 2019 by Occidental Petroleum (Oxy), which bought out US-based Anadarko at the same time. In a letter dated 7 October that Africa Intelligence was able to see, Anadarko WCTP’s country manager in Ghana, Jim Ohlms, has threatened to cancel the sale of its Ghanaian assets to Kosmos Energy and GNPC if the energy ministry does not validate the deal by today, 13 October.

In this letter, Ohlms specifies that “in the event the proposed transactions with Kosmos and GNPC are not completed by October 13th, (…) Anadarko intends to end the sale process and retain these assets”. This development would be bad news for Accra, which had hoped to benefit from the transaction, mainly through taxes (AI, 24/09/21).

Other Buyout Candidates Out Of The Picture?

The lack of progress by the Ghanaian government is not the only factor that has brought the sale to a standstill during the last few weeks. The arrival of several other potential buyers, notably Springfield Energy and International Petroleum Corporation (IPC, AI, 06/10/21), has also contributed to the delay. According to Ohlms, press reports of the presence of other bidders “led to an unreasonable delay in closing our transactions with Kosmos and GNPC”. Anadarko will not enter into discussions with other parties, Ohlms said in his letter, citing Springfield, IPC, Petronor and Boru Energy, who had also expressed interest (AI, 20/08/21).

Discussion about this post