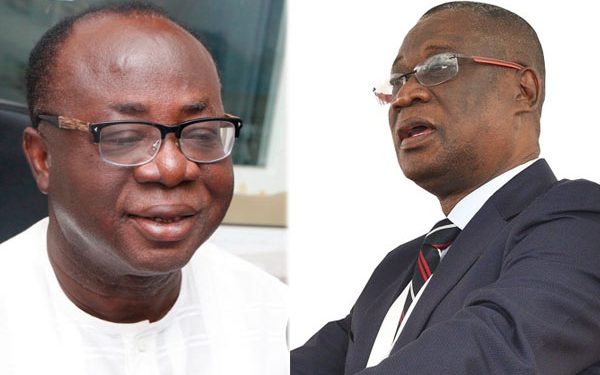

The Herald has picked up intelligence on how the Finance Minister, Ken Ofori-Atta, approved a loan for Freddy Blay and KK Sarpong, to buy the jubilee assets from Occidental under the cover of a Cayman Islands registered Company called Jubilee Oil Holdings.

Last week, among a series of questions by the Africa Center for Energy Policy (ACEP) on the transaction, the source of funding for the acquisition of 7percent interest in Occidental assets was central.

GNPC responded on Friday, January 14, 2022 that the Finance Ministry, provided a loan with interest for the acquisition. Our checks with the Finance Committee of Parliament and Energy Committee shows that no such proposal was ever submitted for consideration and appropriation.

“Anadarko Offshore incorporated JOHL with its own directors. At the time of the sale and purchase, the Corporation was required to nominate two directors to take over after the transfer was effected. The Board of Directors of the Corporation therefore nominated the Board Chairman, Honourable Freddie Blay, and the Chief Executive Officer, Dr. K.K. Sarpong, as initial Board directors to replace the directors of JOHL appointed by Anadarko. The Corporation holds one hundred percent of the shares in JOHL. The beneficial ownership of JOHL can be ascertained by conducting a general search with the Cayman Islands Registry. Further, the Share Purchase Agreement entered into on 13th October 2021, between Anadarko Offshore and Ghana National Petroleum Corporation shows that the shares of JOHL belong to the Corporation as the Buyer”, the GNPC statement had said.

GNPC responded on Friday, January 14, 2022 that the Finance Ministry, provided a loan with interest for the acquisition. Our checks with the Finance Committee of Parliament and Energy Committee shows that no such proposal was ever submitted for consideration and appropriation.

“Anadarko Offshore incorporated JOHL with its own directors. At the time of the sale and purchase, the Corporation was required to nominate two directors to take over after the transfer was effected. The Board of Directors of the Corporation therefore nominated the Board Chairman, Honourable Freddie Blay, and the Chief Executive Officer, Dr. K.K. Sarpong, as initial Board directors to replace the directors of JOHL appointed by Anadarko. The Corporation holds one hundred percent of the shares in JOHL. The beneficial ownership of JOHL can be ascertained by conducting a general search with the Cayman Islands Registry. Further, the Share Purchase Agreement entered into on 13th October 2021, between Anadarko Offshore and Ghana National Petroleum Corporation shows that the shares of JOHL belong to the Corporation as the Buyer”, the GNPC statement had said.

GNPC responded on Friday, January 14, 2022 that the Finance Ministry, provided a loan with interest for the acquisition. Our checks with the Finance Committee of Parliament and Energy Committee shows that no such proposal was ever submitted for consideration and appropriation.

“Anadarko Offshore incorporated JOHL with its own directors. At the time of the sale and purchase, the Corporation was required to nominate two directors to take over after the transfer was effected. The Board of Directors of the Corporation therefore nominated the Board Chairman, Honourable Freddie Blay, and the Chief Executive Officer, Dr. K.K. Sarpong, as initial Board directors to replace the directors of JOHL appointed by Anadarko. The Corporation holds one hundred percent of the shares in JOHL. The beneficial ownership of JOHL can be ascertained by conducting a general search with the Cayman Islands Registry. Further, the Share Purchase Agreement entered into on 13th October 2021, between Anadarko Offshore and Ghana National Petroleum Corporation shows that the shares of JOHL belong to the Corporation as the Buyer”, the GNPC statement had said.

GNPC responded on Friday, January 14, 2022 that the Finance Ministry, provided a loan with interest for the acquisition. Our checks with the Finance Committee of Parliament and Energy Committee shows that no such proposal was ever submitted for consideration and appropriation.

“Anadarko Offshore incorporated JOHL with its own directors. At the time of the sale and purchase, the Corporation was required to nominate two directors to take over after the transfer was effected. The Board of Directors of the Corporation therefore nominated the Board Chairman, Honourable Freddie Blay, and the Chief Executive Officer, Dr. K.K. Sarpong, as initial Board directors to replace the directors of JOHL appointed by Anadarko. The Corporation holds one hundred percent of the shares in JOHL. The beneficial ownership of JOHL can be ascertained by conducting a general search with the Cayman Islands Registry. Further, the Share Purchase Agreement entered into on 13th October 2021, between Anadarko Offshore and Ghana National Petroleum Corporation shows that the shares of JOHL belong to the Corporation as the Buyer”, the GNPC statement had said.

The methodical attempt by the finance minister to present rosy fiscal outlook for the past five years has been shuttered only to the extent of what is very difficult to hide. There appears to be more dealings outside the budget which The Herald is following up on.

In September the family of Akufo-Addo were divided in a race to snatch the Occidental deal away from Kosmos Energy.

Gabby Otchere Darko and Energy Minister, Mathew Opoku Prempeh were in one corner supporting Kevin Okyere’s Springfield and International Petroleum Corporation (IPC) with a bid dated 20th September 2021 when Kosmos had concluded the purchase negotiation in April waiting for the “Minister with interest” to approve the deal.

As a result the Energy Minister would not approve the transaction until diplomatic tensions began to rise between Ghana and the United States.

While pushing the Springfield-IPC deal our source indicates the President Executive Secretary Nana Bediatuo Asante also threw in a last minute wrench with another company he preferred.

Occidental and Kosmos eventually issued a strict timeline for the approval of the transaction to the Minister of Energy or consider the deal canceled which would have cost Ghana close to US$200 million in tax revenues from the sale.

The president had to intervene a night before the deadline with clear instructions to the Energy Minister to approve the transaction, ostensibly to save him from losing donated Covid-19 vaccines from the US. Though the Minister failed to attend the meeting, he had to approve the Kosmos deal.

The methodical attempt by the finance minister to present rosy fiscal outlook for the past five years has been shuttered only to the extent of what is very difficult to hide. There appears to be more dealings outside the budget which The Herald is following up on.

In September the family of Akufo-Addo were divided in a race to snatch the Occidental deal away from Kosmos Energy.

Gabby Otchere Darko and Energy Minister, Mathew Opoku Prempeh were in one corner supporting Kevin Okyere’s Springfield and International Petroleum Corporation (IPC) with a bid dated 20th September 2021 when Kosmos had concluded the purchase negotiation in April waiting for the “Minister with interest” to approve the deal.

As a result the Energy Minister would not approve the transaction until diplomatic tensions began to rise between Ghana and the United States.

While pushing the Springfield-IPC deal our source indicates the President Executive Secretary Nana Bediatuo Asante also threw in a last minute wrench with another company he preferred.

Occidental and Kosmos eventually issued a strict timeline for the approval of the transaction to the Minister of Energy or consider the deal canceled which would have cost Ghana close to US$200 million in tax revenues from the sale.

The president had to intervene a night before the deadline with clear instructions to the Energy Minister to approve the transaction, ostensibly to save him from losing donated Covid-19 vaccines from the US. Though the Minister failed to attend the meeting, he had to approve the Kosmos deal.

The country can only hope that the opposition will intervene in the foregoing to get accountability.

But this hope hangs in the balance as many past government officials in Parliament are held hostage with prosecutable deals they were involved in, rendering them ineffective and fostering safe passage for deals for the Akufo-Addo family.

So whether the 7% will come back to Ghana or not remains an uncertain aspirations for any Ghanaian unless the NDC Minority in Parliament led by Haruna Iddrisu and Muntaka Mubarak, who has described himself as a foster brother of the Energy Minister, is aligned with the suffering of the masses.

Read the GNPC’s response to ACEP press conference

GHANA NATIONAL PETROLEUM CORPORATION RESPONSES TO ASSERTIONS IN AFRICA CENTRE FOR ENERGY POLICY SUMMARY ON GNPC 7% ACQUISITION

Accra, 14th January 2022: The Ghana National Petroleum Corporation’s (“Corporation”) attention has been drawn to comments made by the Africa Centre for Energy Policy (“ACEP”) in a press statement on the above subject. The Corporation’s response to ACEP’s assertions are as follows:

ASSERTION 1

The Corporation has not communicated how it intends to finance the US$199 million acquisition, leading to speculations of illegality in breach of the Petroleum Revenue Management Act, as amended.

RESPONSE

The funds used to acquire the 7% Joint Operating Agreement (commercial) interest of Anadarko WCTP Company in Jubilee, DWT and WCTP was advanced by the Ministry of Finance. As communicated to the Ministry of Finance, the advance would be fully repaid with interest by GNPC Explorco or Jubilee Oil Holdings Limited (“JOHL”) from proceeds of crude sales or funding raised on the debt market.

ASSERTION 2

The Corporation has set up an offshore company in the Cayman Islands to hold the 7% commercial interest rather than owning it directly or through a subsidiary in Ghana. This raises the bar on opacity and worsening accountability associated with the Corporation.

RESPONSE 2

- The Corporation has not set up any offshore company. The facts of the matter are as follows:

a. Anadarko Offshore Holding Company LLC (“Anadarko Offshore”) sought to wind up its operations in Ghana. Its subsidiary, Anadarko WCTP Company (“Anadarko WCTP”) (an offshore company registered in Cayman Islands that holds Anadarko’s interest in Jubilee, Deepwater Tano (DWT) and West Cape Three Points (WCTP)) was to be sold to Kosmos Energy Holdings Ghana Limited (“Kosmos”). The Corporation expressed an interest in acquiring part of Anadarko WCTP’s interest in the DWT and WCTP petroleum agreements and notified Ministry of Energy. The Parties entered negotiations to determine the Corporation’s share, and it concluded with an offer to the Corporation to purchase the 7% commercial interest.

b. To enable the negotiations with Kosmos for the sale of Anadarko WCTP to proceed, Anadarko Offshore incorporated a company, Jubilee Oil Holdings Limited (“JOHL”), in the Cayman Islands to hold the 7% commercial interest in the interim while the parties negotiated and finalised the commercial terms of the transaction.

c. The parties proceeded to negotiate the commercial terms of the sale and purchase of the 7% commercial interest. The headline purchase price as of 1st April 2021 was quoted as US$199million. This price was adjusted to US$165 million effective 30th September 2021, following adjustments for cash calls, taxes and other expenses incurred as well as sales made by Anadarko WCTP within the period.

d. Anadarko Offshore, the Seller, was eventually paid US$164,798,691.00 on 19th October 2021 in full settlement of the acquisition. Anadarko Offshore thereafter assigned JOHL to GNPC, as JOHL holds the 7% commercial interest. e. The Corporation is currently in the process of transferring JOHL to GNPC Explorco. It was never a ploy by the Corporation to ‘live unto itself, not the law and the nation’s strategy for its existence’ as claimed by ACEP.

ASSERTION 3

Holding on to the assumption that GNPC owns Jubilee Oil Holding Limited, it is still not enough for the company to transact business in Ghana’s oil industry without registering with the Registrar General.

RESPONSE

The Corporation is in the process of registering JOHL as an external company in Ghana.

ASSERTION 4

GNPC at the time of communicating to the public knew that its intention was to assign the interest to a company called Jubilee Oil Holdings, registered in the Cayman Islands, with Dr K.K. Sarpong and Mr. Freddie W. Blay as directors. ACEP’s search has not yet ascertained beneficial owners of Jubilee Oil Holdings. It is important to note that the representation of the CEO and Board Chair of GNPC, with their names in the General Registry of Cayman Islands, is not enough proof that GNPC is the owner of the Jubilee Oil Holdings.

RESPONSE

Anadarko Offshore incorporated JOHL with its own directors. At the time of the sale and purchase, the Corporation was required to nominate two directors to take over after the transfer was effected. The Board of Directors of the Corporation therefore nominated the Board Chairman, Honourable Freddie Blay, and the Chief Executive Officer, Dr. K.K. Sarpong, as initial Board directors to replace the directors of JOHL appointed by Anadarko. The Corporation holds one hundred percent of the shares in JOHL. The beneficial ownership of JOHL can be ascertained by conducting a general search with the Cayman Islands Registry. Further, the Share Purchase Agreement entered into on 13th October 2021, between Anadarko Offshore and Ghana National Petroleum Corporation show that the shares of JOHL belong to the Corporation as the Buyer.

ASSERTION 5

The PRMA, since its inception, has suffered many accountability challenges. But for any revenue to be encumbered outside the express dictate of the law will be the final nail in the coffin of the Act, a precedent that will undermine the very existence of the Act. There is no individual, institution or authority clothed with the power to appropriate petroleum revenue outside the PRMA, even if the act can be justified as necessary.

RESPONSE

The Corporation has always operated within the remit of the laws and regulations of the Petroleum Industry, including the Petroleum Revenue Management Act, as amended, and has no intention of doing otherwise. JOHL was duly incorporated under the law of the Cayman Islands by Anadarko 4 Offshore in line with the legal framework under the governing petroleum agreements. The Corporation is in the process of registering JOHL as an external company in line with Ghanaian law.

CONCLUSION

The Corporation continues to operate within the remit of the legal framework and has no intention of flouting any legal requirements and procedures. As the Corporation has always indicated, the Corporation welcomes engagement with any stakeholder in its operations. All documents on the transactions are available for scrutiny and inspection.

Discussion about this post