The Ghana Cocoa Board (COCOBOD) has responded to claims of consistent default on its loans, clarifying its financial obligations and repayment status.

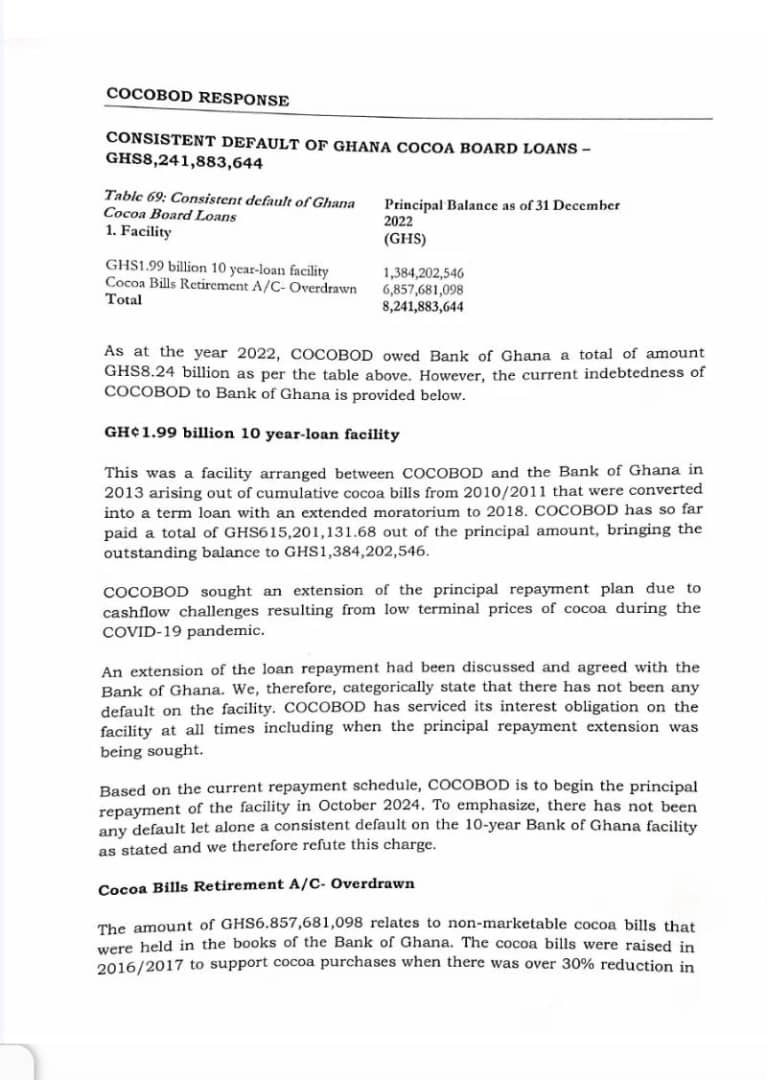

According to COCOBOD, as of December 31, 2022, its total debt to the Bank of Ghana stood at GH¢8.24 billion.

This includes a GHS1.99 billion 10-year loan facility and an overdrawn Cocoa Bills Retirement Account amounting to GH¢6.86 billion.

COCOBOD explained that, the GH¢1.99 billion loan, arranged in 2013, was intended to address cumulative cocoa bills from the 2010/2011 season, with an extended moratorium until 2018 due to cash flow challenges exacerbated by low cocoa prices during the COVID-19 pandemic.

Despite some delays in principal repayments, COCOBOD has consistently serviced the interest and has arranged a revised repayment schedule to begin in October 2024. The Board further categorically denied any default on this facility.

Regarding the overdrawn Cocoa Bills Retirement Account, COCOBOD attributed the balance to non-marketable cocoa bills from 2016/2017, which were necessary to sustain cocoa production amid reduced international prices and shifting agricultural interests.

These bills were rolled over at high interest rates due to economic conditions.

However, during the 2023 Domestic Debt Exchange Program, the government absorbed a significant portion of this debt, granting COCOBOD a 50% discount. The remaining balance is still recorded but does not reflect the full amount originally claimed.

COCOBOD’s Public Affairs Department asserts that the Board has not defaulted on its obligations and continues to manage its debt responsibly.

Discussion about this post