An audit report by the renowned auditing firm, PwC, has uncovered some troubling revelations in the financial records of the nation’s power distributor, the Electricity Company of Ghana (ECG).

The audit report, which examined ECG’s books for the 3rd quarter of 2024, revealed significant inconsistencies in the total revenue collected by the company.

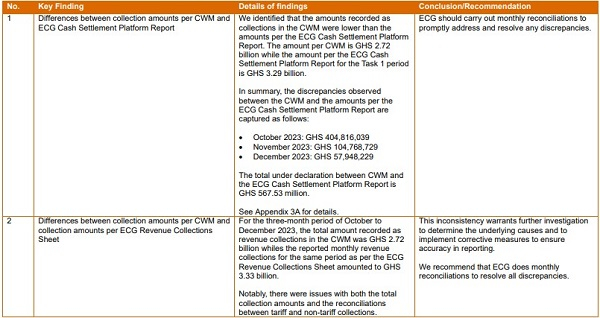

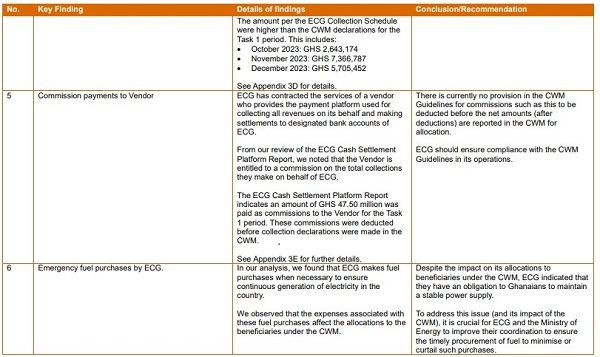

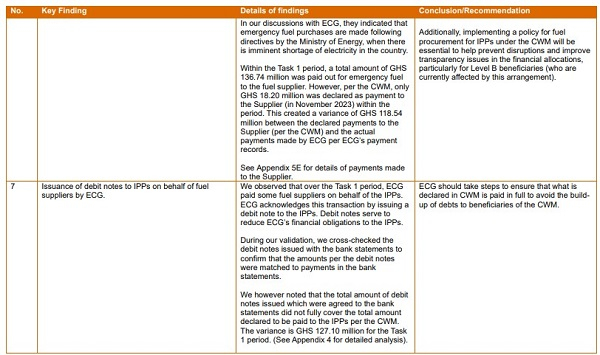

For example, the audit report highlighted a substantial variance between the collection amounts recorded in the cash waterfall mechanism (CWM) – a system designed to ensure the equitable distribution of revenues collected by the company – and the ECG Cash Settlement Platform Report.

It was discovered that the total revenue generated for the 3rd quarter in the CWM was approximately GH¢600 million less than the amount reported on the company’s platform report.

“We found that the collection amounts in the CWM were lower than those in the ECG Cash Settlement Platform Report. The CWM recorded an amount of GH¢2.72 billion, while the ECG Cash Settlement Platform Report for the Task 1 period showed GH¢3.29 billion.

“In summary, the discrepancies between the CWM and the amounts in the ECG Cash Settlement Platform Report are as follows:

• October 2023: GH¢404,816,039

• November 2023: GH¢104,768,729

• December 2023: GH¢57,948,229,” excerpts from the report revealed.

The PwC report also highlighted differences between the collection amounts in the CWM and ECG’s Revenue Collections Sheet.

“For the three-month period from October to December 2023, the total revenue collections in the CWM amounted to GH¢2.72 billion, whereas the monthly revenue collections reported in the ECG Revenue Collections Sheet for the same period totaled GH¢3.33 billion.

“Significantly, there were discrepancies in both the total collection amounts and the reconciliations between tariff and non-tariff collections,” it added.

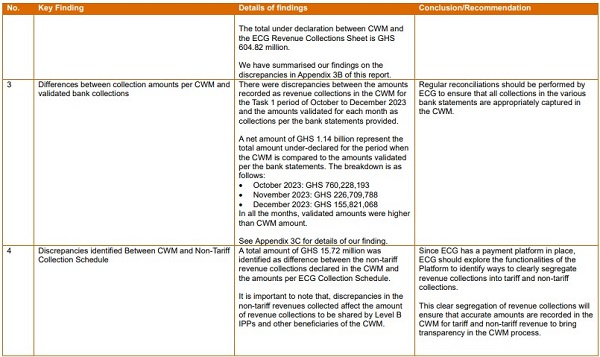

Additionally, the report found that the total revenue in the CWM was GH¢1.14 billion less than the total amount of money in the company’s bank statements.

It also revealed that ECG maintained 84 bank accounts with 20 different banks, despite a directive to consolidate all revenue collections and disbursements into a single account.

See details of the report below:

Discussion about this post