Despite the ravages of COVID-19, the Association of Rural Banks (ARB) Apex Bank Limited, has recorded the highest profit before tax (PBT) of GH₵5.

9 million.

This is an increase of 482 percent over the previous year, the highest PBT in more than 10 years.

The Bank’s total operating income also grew from GH₵65 million in 2019 to GH₵75.3 million, a jump of 16 percent in the year under review.

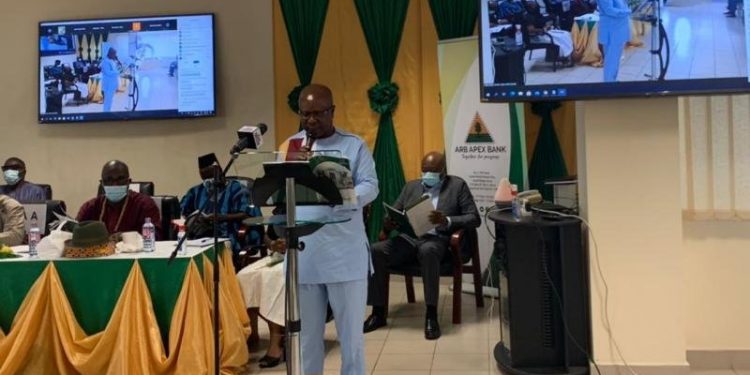

Mr Kojo Mattah, the Managing Director of ARB Apex Bank, at the Bank’s 19th Annual General Meeting, said the total assets also upended the previous year’s performance by 29 percent, growing from GH₵582.4 million in 2019 to GH₵751.9 million in 2020.

He said deposits also rose by 33 per cent from GHc488.9 million in 2019 to GH₵684.5 million in 2020.

“All these positive indicators and trends are indicative of the fruits of the vision of our Directors and hard work of the Management and Staff,” he said.

Mr Mattah said the banking sector had been experiencing a constant flux of sweeping changes, aided largely by technology and innovation.

In order to keep pace with these changes and to break out of their silos, leadership of the Bank decided to invest heavily in key growth sectors of the Bank, he said.

“We have continued to invest heavily in Information and communication technology, which has become key business enabler all over the world. Today, we can boast of a modern ICT backbone, which is helping us develop innovative customer-centric products for our customers,” he added.

He announced that the first phase of the Agency Banking project, being feasibility study and business modelling, had been completed.

“We are in a process of selecting a service provider to support the deployment of the shared Agency Banking platform, expected to sign up at least 5,000 bank agents,” he said.

Mr Mattah said the strategic positioning of the Bank remained a top priority for management, which was why they continue to adopt contemporary marketing and public relations tools to help improve its image and that of member banks.

He said the Bank had a collaboration with the National Board for Small Scale Industries, now the Ghana Enterprises Agency, in the disbursement of loans to beneficiaries through their RCBs across the country under the Coronavirus Alleviation Programme Business Support Scheme (CAPBuSS).

The collaboration had resulted in the disbursement of GH₵26.5 million of the CAPBuSS by 70 RCBs and to over 9,000 beneficiaries, he said.

Mr Mattah said they had initiated negotiations with other institutions to generate more strategic partnerships for the benefit of member banks.

“The cooperation of the RCBs in these collaborations is highly commendable and we shall continue to count on their support in the coming years,” he said.

Dr Anthony Aubynn, the Board Chairman of ARB Apex Bank Limited, said the performance of the banking sector remained strong at the end of 2020, with robust growth in total assets, deposits and investments.

He said the increase in total assets resulted in strong growth in investments in government securities.

He said the increase in total assets resulted in strong growth in investments in government securities.

The Board Chairman said total deposits recorded significant year-on-year growth reflecting strong liquidity flows, emanating from the COVID-19 fiscal stimulus and payments to contractors.

“Overall, the impact of the pandemic on the industry’s performance seems moderate as banks remain liquid, profitable and well-capitalised,” he added.

Source:

GNA

Discussion about this post