The Ghana Revenue Authority (GRA) has dismissed claims by the Abossey Okai Spare Parts Traders Association that the new Value Added Tax (VAT) regime will lead to higher prices and distort market competition.

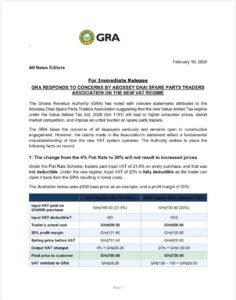

In a statement dated February 10, 2026, the GRA explained that the transition from the 4 percent flat rate to the 20 percent standard VAT under the Value Added Tax Act, 2025 (Act 1151) will rather reduce costs when properly applied, as input VAT is now fully deductible.

According to the Authority, a pricing illustration shows that the final price to consumers under the new regime is lower than under the old system, blaming current price increases on pricing errors by traders who have failed to remove deductible input VAT from their cost calculations.

The GRA further noted that the increased VAT registration threshold of GH¢750,000 is a relief measure for small traders and does not create unfair competition. It also highlighted benefits of the new regime, including lower effective tax rates, abolition of the COVID-19 levy, elimination of cascading taxes, and reduced cost of doing business.

The Authority has called on traders to engage constructively and announced the establishment of a joint technical team with GUTA to support businesses through the transition.

By: Bernard Mensah

Discussion about this post