Governor of the Bank of Ghana (BoG), Dr Ernest Addison, has said that Ghana expects the board of the International Monetary Fund (IMF) to meet before the end of the year to consider the release of the second tranche of the $ 3 billion cash.

This follows the successful review of the $600 million first tranche.

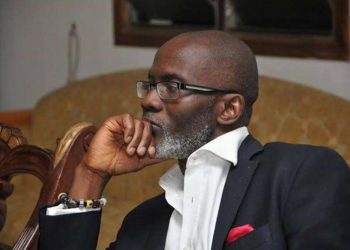

Dr Addison said this while answering questions at the 115th Monetary Policy Committee (MPC) press conference in Accra on Monday, November 27.

He said “We expect the IMF board meeting to take place before the end of the year, which should also trigger another disbursement of foreign exchange.”

Earlier, the Minister of Finance Ken Ofori-Atta Ghana indicated that Ghana met all six of the Quantitative Performance Criteria (QPCs) during the first review.

Presenting the 2024 budget statement to Parliament on Wednesday, November 15, Mr Ofori-Atta explained that the IMF-supported Post COVID-19 Programme for Economic Growth (PC-PEG) is assessed semi-annually by the IMF through an IMF staff review mission followed by final approval by the IMF Executive Board.

Disbursements under the Programme are tied to the successful completion of each review, he added.

The reviews assess Ghana’s progress towards meeting the Quantitative Performance Criteria (QPCs), Indicative Targets (ITs), and Structural Benchmarks (SBs).

Ghana’s first review commenced with the IMF fielding a mission to undertake a staff assessment from 25th September to 6th October 2023.

This review covered the assessment of:

i. six (6) Quantitative Performance Criteria (PCs);

ii. one (1) Monetary Policy Consultation Clause (MPCC) for inflation;

iii. three (3) Indicative Targets (ITs); and

iv. nine (7) Structural Reform Benchmarks (SBs) that were due at the end of September 2023.

“I am glad to inform this august house that based on the IMF’s own assessment (at the staff level) after the first review, Ghana met All six (6) of the Quantitative Performance Criteria (QPCs). The QPCs are a floor on net international reserves, ceiling on primary balance on commitment basis, ceiling on contracting non-concessional loan/guarantee, zero collateralized borrowing, and no accumulation of external debt service arrears.

“Two (2) out of the 3 Indicative Targets. The two ITs met are a floor on social spending and a floor on non-oil public revenue. The IT on zero net accumulation of payables was extended largely due to the ongoing negotiations with Energy Sector IPP on legacy debt; .

“Six (6) out of the seven (7) Structural Benchmarks due end-September 2023. The six SBs met are (a) preparation and publication of arrears clearance and prevention strategy, (b) preparation and publication of financial sector strengthening strategy, (c) preparation and publication a strategy for review of earmarked (statutory) funds, (d) preparation and

publication of a medium-term revenue strategy, (e) a strategy for indexation of LEAP benefits and (f) BoG to approve capital building buffer plans for banks. The seventh SB on the preparation and publication of an updated Energy Sector Recovery Plan which was expected to be completed at the end of June 2023 was strategically completed and

published on the MoF website in October 2023.

“Mr. Speaker, the outstanding performance of Ghana during the first (1st) review paved the way for Ghana to reach a Staff Level Agreement (SLA) with IMF on the 6th October 2023, a record five (5) months after the Programme was approved in May 2023.”

Discussion about this post