Fraud in mobile banking can be difficult to detect, and consumers often do not know they are targeted after the transaction occurred.

This can lead to consumer distrust of mobile banking services, particularly for consumers who have a higher chance of experiencing fraud.

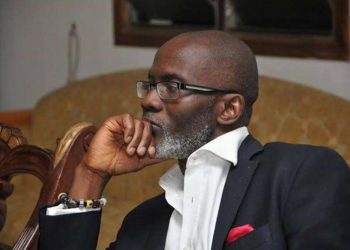

Speaking to D.K Cyber, a cyber security expert on Plan B FM morning show NKOSUONSEM, he told Nana Yaw Abrompah that

cybercriminals have developed sophisticated means to rob unsuspecting users of the mobile money service as well as users of other electronic payment services.

Fraud particularly on the Mobile Money service has been on the rise. According to a report by MTN, it receives about 365 complaints of fraud from subscribers every month. It also said it has blocked over 400,000 scam messages daily on its network.

He then advised the general public not to share their secret code with anybody be it a mobile money code, or bank details, or preventably should not entertain anyone on the phone claiming to be a staff or a worker from their banks or service providers.

“What they do is that, they call you and portray as if they are workers of your bank, so immediately you notice that tell them you will go to the bank yourself to and find out, he added.

Discussion about this post