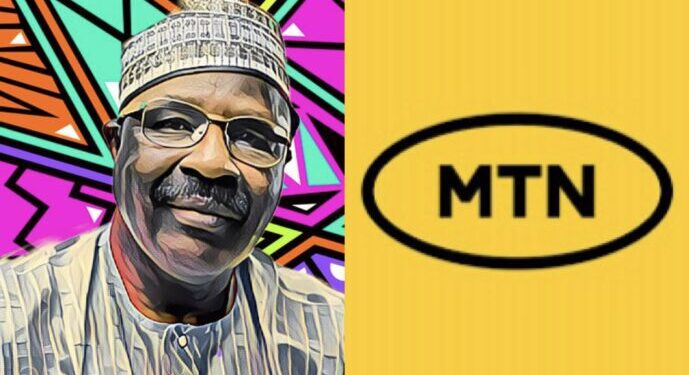

Cameroon’s richest man, Baba Ahmadou Danpullo has delivered a significant blow to MTN Cameroon through his legal actions, resulting in the freezing of the company’s bank accounts.

This unprecedented move has forced MTN Cameroon to seek substantial loans to stabilize its operations.

As a direct consequence of Danpullo’s legal action, which resulted in the seizure of MTN Cameroon’s bank accounts, the telecom giant found itself grappling for financial stability.

During the first half of 2023, MTN Cameroon was compelled to secure a staggering FCFA91.5 billion ($151.8 million) in syndicated loans from undisclosed banks. This financing was vital to meet the company’s working capital requirements and to cover its operational costs during the period under review.

This substantial loan amount constituted nearly 98 percent of the firm’s operational expenditures for the stated time frame.

Despite MTN Cameroon’s impressive performance in the first half of 2023, including a remarkable turnover of FCFA156 billion ($258.8 million), an operating margin of 36 percent, and a dominant market share of 51.4 percent, the company’s financial stability was shaken due to the legal dispute initiated by Danpullo.

MTN Cameroon concluded the previous year, 2022, without fresh loans while maintaining a favorable net cash flow. However, the financial landscape drastically changed by the end of June 2023, revealing a net debt of FCFA13 billion ($21.6 million), indicative of the turmoil caused by the ongoing legal battle.

Earlier this year, Danpullo accused Johannesburg-based First National Bank (FNB) of orchestrating the misleading seizure and liquidation of his South African properties.

Danpullo’s allegations stem from a R520 million ($30.6 million) loan he secured from FNB in 2017 to acquire the 1 Thibault building in Cape Town. Despite adhering to the stipulated repayment plan, FNB seized and liquidated Danpullo’s properties worth R4 billion ($235.4 million) in 2020.

The consequences of Danpullo’s legal actions have rippled beyond financial institutions, sparking intense public outrage and parliamentary debates in Cameroon. Civil society activists in the country have called for protests against South Africa, although Danpullo expressed optimism about resolving the issue through diplomatic means.

Earlier this year, a Cameroonian court granted Danpullo the authority to freeze the bank accounts and assets of Chococam and MTN, both subsidiaries of the Public Investment Corporation, which also holds stakes in FirstRand Bank, FNB’s parent company.

Discussion about this post