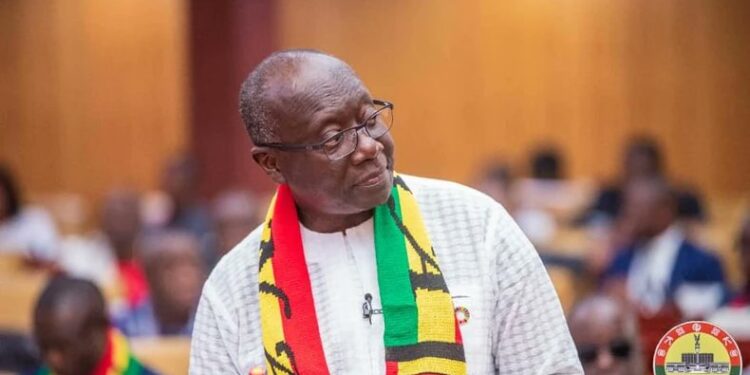

The Minister for Finance, Ken Ofori-Atta has warned that the government’s determination to secure a credit facility from the International Money Fund (IMF) next month, will hit the rocks if the three outstanding revenue bills are not passed by Parliament with urgency.

He has, therefore, passionately appealed to Parliament to pass these bills, to make the seeming muddy road smooth for the government.

These bills are; the Income Tax (Amendment) Bill, Excise Duty & Excise Tax Stamp (Amendment) Bills as well as the Growth and Sustainability Levy Bill.

“Mr. Speaker, the passage of these Bills will enable Government to complete four (4) of five (5) agreed Prior Actions in the Staff Level Agreement since Tariff adjustment by the Public Utilities Regulatory Commission (PURC), Publication of the Auditor-General’s Report on COVID-19 Spending and onboarding of Ghana Education Trust Fund, District Assembly Common Fund and Road Fund on the Government Integrated Financial Management System have all been completed,” he stated.

According to him, the passage of the bills would also help to boost efforts at increasing our Tax-to-GDP from less than 13% to the sub-Saharan average of 18%.

He made the appeal last Thursday when he appeared before the House to deliver a statement on government’s Domestic Debt Exchange Programme (DDEP).

This appeal was rehashed by a deputy Minister for Finance, Abena Osei Asare, Member of Parliament for Atiwa East.

Wrapping up her comments on the minister’s statement, the Atiwa East MP indicated that the three outstanding revenue measures if passed, will also help the country reach an agreement come March.

“So, we are pleading with the House that the Income Tax bill, the Growth and Sustainability bill, as well as the amendment of the Excise Duty tax. We are asking that you support us pass these three outstanding revenue measures to compliment the debt exchange that we have done to help us reach an agreement with the IMF, she added.

Considering that the government is determined to secure the Bretton Woods Institution’s board’s approval by the end of the first quarter (next month), Parliament has probably less than a month to pass these three bills.

Besides, the government has repeatedly indicated that the economy may grind to a halt in the event the IMF deal goes beyond ending of March.

“Mr. Speaker, I cannot emphasise enough, the need to secure the Board Approval for our IMF Programme by the end of March, 2023.

“I, therefore, entreat the House to prioritise the approval of the outstanding Revenue Bills and the various concessional facilities,” Ofori-Addo said.

ALTERNATIVE FUNDING

In the concluding part of his presentation, the Minister for Finance stated that the government was relying on the Treasury Bills and Concessional loans as the primary sources of financing for the 2023 fiscal year.

He explained that the development was as a result of the international and domestic bond markets been shut for the financing of the government’s programmes.

He, therefore, called on the House to support the government’s financing requests to ensure a smooth recovery from the economic challenges.

Meanwhile, Ofori-Atta has assured the House that he will return with the necessary fiscal adjustments after the debt operation is completed for Parliament’s consideration and approval.

Discussion about this post