In a deal that saw Parliamentary approval of E-levy on 29th March 2022, the two major political parties in Parliament, i.e., the New Patriotic Party (NPP) and the National Democratic Congress (NDC), apparently failed to disclose the disappearance of fifteen per cent (15 %), or a whopping $65 million, from the top of this tax’s annual revenues. This sum does not include disappearance downstream from revenues of GHS 6.9 billion that the Government admits will actually come in.

Two sets of facts make this conclusion apparent: the manner of the Government’s changing E-levy revenue predictions and the alleged behaviour of certain NDC leaders surrounding the bill’s passage.

Initially, without ever releasing any report that might give details, the Government estimated collecting $1.15 billion in revenues from E-levy at the tax rate of 1.75 per cent. When the Government lowered this tax rate to the 1.5 per cent that won Parliamentary consent, the revenue projection also dropped to an announced GHS 6.9 billion. This GHS 6.9 billion translates to $920 million calculated at the then exchange rate of $1.00 = GHS 7.51.

However, since 1.5 is 85.71 per cent of 1.75, we would have expected the Government’s published revenue projection to fall from the initial $1.15 billion by the same percentage (85.71 % of) to $985 million. Instead, it fell all the way to $920 million, $65 million less than and only 80 % of the initial $1.15 billion.

What happened to the missing $65 million between the expected $985 million take at a 1.5 % tax rate and the $920 million the Government now claims will actually result from a 1.5 % tax rate?

Apparently, either NPP insiders allegedly gifted all of this $65 million to NDC counterparts in exchange for permitting passage, since NPP Government officials will have control of the remainder of the revenue stream, $920 million, or the two sides agreed to split it.

The behaviour of NDC chieftains shows their apparent acceptance of E-levy and its benefits.

A few days before the Government brought E-levy to the floor for passage, my piece predicting E-levy exploitation appeared on multiple Ghanaian media platforms titled, Corruption is the Root Cause of Ghana’s Woes.”

Former President Mahama then came to both his and the Government’s defence, headlining a story appearing the day of the parliamentary vote on ghanaweb.com, “Mismanagement caused Ghana’s economic woes.”

White-washing corruption by calling it benign mismanagement removes the criminal stigma. As Mahama well knows, muddying the waters makes it more difficult to see.

If Speaker Bagbin had absented himself from Parliament when the NPP planned to revive E-levy, he would have caused a Deputy Speaker to fill his seat, denying the Majority one more vote in favour. As it was, after the Minority made a show of leaving the Chamber, he failed to call a quorum. Even some NDC officials admit the chances of Supreme Court reversal are slim.

The NPP Government seemingly hid the discrepancy between what should have been the revenue estimate from a 1.5 per cent tax, $985 million, and the amount it misleadingly announced will be the revenue intake, $920 million, in several ways.

First, it published the revenue estimate at the original, 1.75 % rate in U.S. dollars, $1.15 billion, and cleverly issued the false estimate at the lower, 1.5 % rate in Ghana cedis, GHS 6.9 billion, thus requiring the currency conversion done above to detect the missing revenue.

Second, it withheld the 1.5 per cent rate and its apparently falsified lower revenue estimate until the day parliament took up and passed the measure, shielding parliamentarians and the public from the unsettling revelation made in this report.

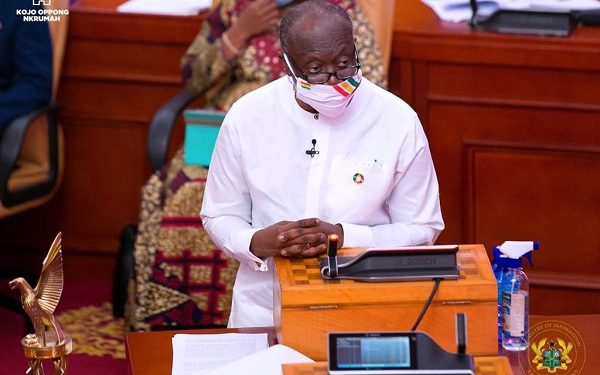

Third, as experts such as Bright Simons of IMANI Africa complained at the time, the Finance Minister intentionally failed to publish any details supporting his original revenue estimate of $1.15 billion. He allegedly knew then that he was prepared to induce the opposition to cooperate by assuring some of their insiders a slice of the E-levy revenue.

Publishing details would have tied them down and prevented the Finance Minister from being able to excuse that so-called “new exemptions” are the cause of the disproportionate reduction in announced revenue.

I publicly predicted political leaders’ conniving to rig E-levy, due unfortunately to Ghana’s entrenched culture of corruption. Cowardice and dishonesty succeed today in postponing a day of reckoning but will make it more profound and painful when it happens tomorrow.

Former President Mahama began laying the ground on the very day of E-levy’s passage. He said if re-elected, he was already planning to consider cuts to the Free Secondary School programme since the IMF bailout his last administration welcomed was too bitter to repeat.

Law School Dean Raymond Atuguba told us insiders’ real reason for avoiding another IMF bailout: it would begin with an audit. They fear exposure of their theft from the $5 billion in COVID-19 relief the Government managed to secure, a prospect Atuguba admitted makes him, and perhaps also Mahama, “shudder.”

How long will last the $920 million or remaining GHS 6.9 billion after the first $65 million disappear? Not long. It took fewer than two years to burn through the $5 billion that Government borrowed to combat COVID-19. We have not heard the end of this story.

Discussion about this post