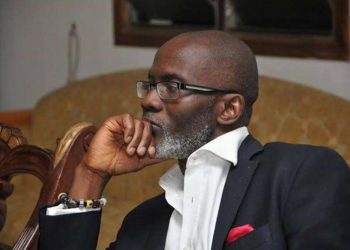

The prosecution has begun its cross-examination of the Founder and Chief Executive Officer of the defunct Capital Bank, William Ato Essien, who is standing trial for his alleged role in the collapse of the private bank.

The accused opened his defence and denied conspiring with anyone to commit any crime when he was in charge of the insolvent bank.

He insisted in his witness statement that he did not act with Fitzgerald Odonkor or Tetteh Nettey who are also on trial, to act together or facilitate any crime and the transfer of funds were legitimate investments by Capital Bank.

The prosecution led by Evelyn Keelson, a Chief State Attorney, began cross-examining the Ato Essien, focusing on some companies owned by the embattled businessman which she said ‘benefited’ from the GH¢620 million Bank of Ghana liquidity support which the prosecution said was misused.

Mr. Essien, while under cross-examination, appeared to have forgotten some vital information relating to the setting up of some of the said companies and who the majority shareholders were.

For instance, he told the court that he could not recollect that he was the sole shareholder in Essien Swiss, a company that was the sole shareholder of Capital Africa Group, which in turn held the majority shares in Capital Bank.

Again, Ato Essien said he was struggling to recollect that his co-accused, Tetteh Nettey, was the majority shareholder in MC Management Services, a company that got GH¢130 million out of the GH¢620 million which was later used in the establishment of the now defunct Sovereign Bank.

Mrs. Keelson, therefore, put it to him that he was the one who recruited Mr. Nettey to set up MC Management Services so there was no way he could have forgotten about that piece of evidence.

“Like I said earlier, kindly forgive my memory and also in this box, I genuinely didn’t remember. Additionally, I recruited Dr. Tetteh Nettey under the strict instructions of Dr. Rahman,” Ato Essien replied.

The prosecutor then suggested to the accused that MC Management Services was set up purposely to use it to raise money to set up Sovereign Bank but Ato Essien said that was not the case and insisted that the company had plans to venture into real estate.

“In fact, the purpose was for MC Management to raise GH¢130m as capitalisation for Sovereign Bank, and you were behind this enterprise of setting up the company and raising the money,” Mrs. Keelson reiterated but the accused denied it and said Dr. Rahman was behind the company.

She then asked Ato Essien whether he was aware of the arrangement to get GH¢100 million from Capital Bank through All Time Capital for MC Management Services was through a commercial paper.

Even though Ato Essien replied ‘yes’, he said he was not aware Tetteh Nettey was the one who signed the commercial paper with Capital Bank.

Mrs. Keelson further put it to Ato Essien that not only did Capital Bank not receive interest on the GH¢100 million arraignment, it did not even get the principal sum and he, the accused, was aware.

Ato Essien denied that assertion by the prosecutor too.

“There are no documents in terms of investment certificate or any other supporting documents for the supposed placement and this has been confirmed by the Head of Treasury at the time in his evidence before this court,” the Chief State Attorney fired.

“It cannot and never unimaginably be that a bank will dole out GH¢100 million without documentation. Then Mr. Kontor should be the one in this box and not me. How can you dole out GH¢100 million without record and you call yourself a treasurer of a bank. He must be here to answer questions,” Ato Essien rebutted.

She asked the accused whether the GH¢100 million which was taken from Capital Bank through All Time and later MC Management Services ended in his Capital Africa Group account but Essien denied it saying the money ended up in the setting up of Sovereign Bank.

He, however, admitted that he indicated in his own witness statement that the money went to Capital Africa Group and was latter used by Capital Africa group to acquire shares in Sovereign Bank.

Mrs. Keelson also asked the accused whether he knew anything about a company by name Britling Services which he set up for one Felix Koranteng. He said he knew about the company adding that the said Koranteng was a shareholder in the company but denied setting it up for him.

When he was also queried about email correspondents between him and Felix Koranteng when the latter wanted to resign from running Britling Services, Ato Essien said he was taking his instructions from Dr. Rahman although he was not copied in any of the emails.

She further queried him on the fact that GH¢35 million, out of GH¢65 million which was taken from Capital Bank through Nordia Capital and MC Management Services went to Britling Services but later ended up in the accounts of Capital Africa Group.

He told the court that he did not remember and would be grateful if he could be assisted with the reference of the transaction.

Hearing continues on February 17.

Discussion about this post