The Centre of Excellent Leadership and Accountable Governance, a Civil Society Organisation (CSO), has called on government to withdraw the Electronic transaction levy (e-levy) tax policy in this challenging times to avert any hardship on the ordinary Ghanaian, especially in the informal sector .

It urged the government to employ innovative ways to implement old tax policies that would robe in more contributions into the tax net.

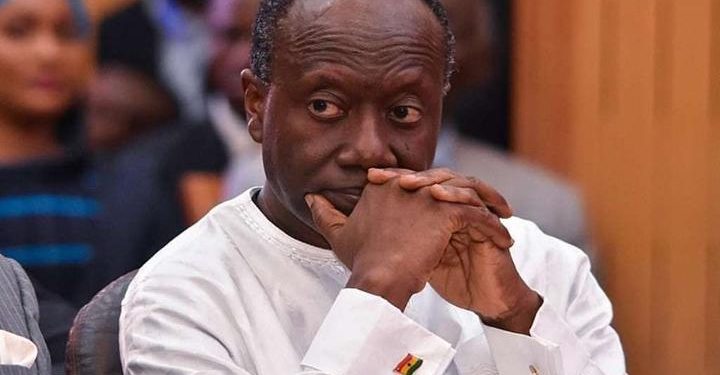

At a press brief in Accra at the weekend, the Executive Director of the organisation, Dr Z. O. Hunter, named the existing policies as property rates, Value Added Tax (VAT), import and export tax, road tolls, other local levies which must be widen instead of new ones.

According to him, COVID-19 had brought untold hardship on Ghanaians, especially where businesses had collapsed over the period leaving many people into poverty.

What government needs now is a consistent effort to block all revenue loopholes in the system.

Unfortunately, he said successive governments have failed to implement these policies which could have raked in more formal and informal sector workers into paying their taxes for the country to generate enough revenue.

According to Dr Hunter, the country can achieve the maximum good of all policies through massive public education on the benefit of paying taxes targeted at the informal sector .

The Executive Director was of the view that if the public trusts the prudent use of their taxes for a collective developmental good, they won’t be reluctant in contributing to it.

The Executive Director was of the view that Parliamentarians must, first of all, consider the effect and pressure their policies formulation will have on the masses at various constituents, especially on those at the road side, market and other place toiling to make ends meet.

Dr Hunter said while the Minority in Parliament opposed the e-levy tax that was captured in the 2022 budget, he was of the view that as a listening government, the Majority and Minority will consider the voice of the masses and adhere to the call to remove the e-levy tax from the 2022 budget.

Discussion about this post