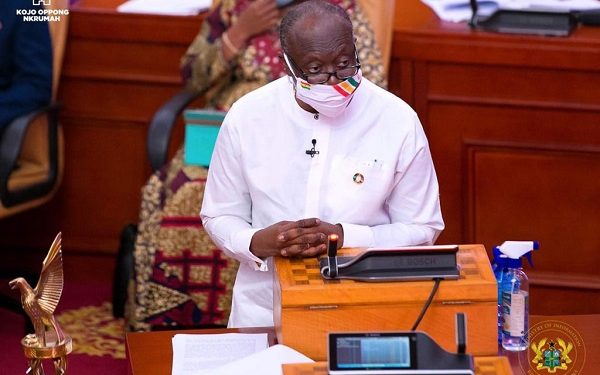

The finance minister Hon. Ken Ofori Atta delivered the budget for 2022 today. In this budget, some taxes were introduced while others were adjusted. However road toll levy was abolished. Even though parliament is yet to debate and approve or otherwise the budget, the government has gone ahead to abolish road tolls across the country with immediate effect.

In place of this, the Government is seeking to introduce electronic tax known as MOMO tax. However, the minority caucus in parliament has promised to reject the new levies since it will burden Ghanaians who are already living in distress.

The following taxes were affected

Increased VAT by 5% and this affected all items (through the decoupling of NHIL and GETFund Levies)

Luxury car tax

3% VAT flat rate

COVID-19 tax

Sanitation tax

5% National Fiscal Stabilization Levy (should have expired in December, 2017 but was extended indefinitely making it a new tax)

2% component of Special Import Levy (extended beyond 2017 sunset clause making it a new tax)

Increased ESLA by 30% and extended for another 15 years

Increased Communication service tax by 50%

Increased VAT Flat rate from 3% to 4%

Financial Sector Levy of 5% on all Banks

Price Stabilization and Recovery Levy on fuel increase by 40%

The Unified Petroleum Pricing Formula has been increased by 164%

BOST margin has increased from 3 Pesewas to 9 Pesewas representing 200% increase.

The fuel marking margin levy has also been increased by another 233%

Reversal of Benchmark Values discounts which will lead to a 25-30% increase in prices of imported items.

Electronic Transactions Levy which will affect Momo, Bank Transfers, Merchant Payments and Inward Remmitances.

15% in All government fees and charges

In all, a total of eighteen taxes are recorded in the 2022 budget.

What is your take on this budget? Take to the comments section to express yourself.

Discussion about this post