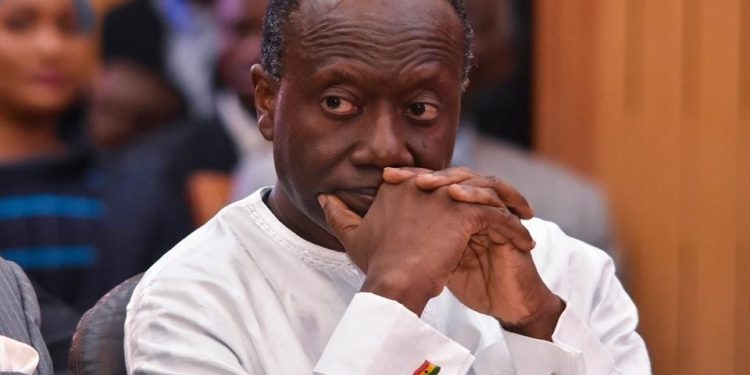

The Finance Minister painted a dire picture of the revenue mobilisation hurdles Ghana has to surmount in its bid to become a country beyond aid.

Less than 10 percent of Ghana’s 30.8 million population pay direct taxes, in a situation Ken Ofori-Atta said was “a poor reflection” on the country when compared to other middle-income countries.

“Only 2,364,348 are bearing the burden of the entire population as taxpayers as of August 2021,” he outlined in his budget presentation in Parliament on Wednesday.

The Minister juxtaposed this figure with the registered voter population of 17 million, which gives an indication of the number of Ghanaians aged 18 and over.

This is a trend that needs to be addressed “to build a more equitable society,” Mr. Ofori-Atta stressed.

Giving a further breakdown, the Minister indicated that only 45,109 entities are registered as corporate taxpayers.

Only 54,364 persons are registered as self-employed taxpayers at the Ghana Revenue Authority, and only 136,198 entities are registered businesses at the Registrar-General’s Department as at August 2021, of which 80 percent are self-employed, the Minister added.

Mr. Ofori-Atta urged the country to resolve that “by the next census, we should have changed these statistics to become an Upper Middle-Income Country in line with our Ghana Beyond Aid agenda.”

“We must eclipse a 20% threshold of revenue to GDP ratio by 2024,” he noted as a target.

Earlier in the budget presentation, Mr. Ofori-Atta said this will require that “we share the burden so that every adult Ghanaian will contribute to the delivery of critical infrastructure, social services and improve lives.”

“This revenue mobilisation must be a collective effort, and we must all contribute to make this a reality,” he added.

Discussion about this post